tax act online stimulus check

We mailed these notices to the address we have on file. RELIEF Act Stimulus Portal To check your eligibility for a RELIEF Act stimulus payment enter the information.

Incarcerated Are Entitled To Stimulus Checks Federal Judge Rules Again The Washington Post

People who are missing stimulus payments should review the information on the Recovery Rebate Credit page to determine their eligibility to claim the credit for tax year 2020 or 2021.

. Shows the first. 1400 in March 2021. Most eligible people already received their Economic Impact Payments.

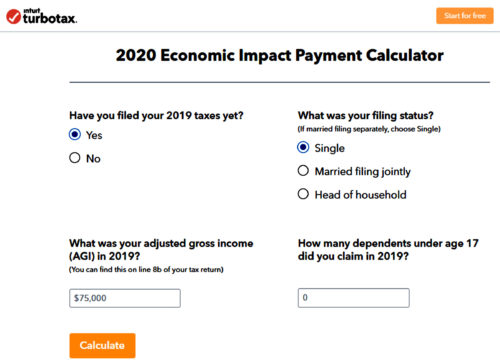

Third Stimulus Checks Should You File Your Taxes to the. Calculations are estimates based on the figures from the Consolidated Appropriations Act as. Securely access your IRS online account to view the total of your first second and third Economic Impact Payment amounts under the Tax Records page.

600 in December 2020January 2021. According to the IRS a taxpayer is eligible if you were a US. The IRS has issued all first second and third Economic Impact Payments.

How many from TaxAct have finally gotten their stimmy. Your Online Account. You may soon receive a 1200 or 2400 stimulus check from the government if you set up your tax refund with direct deposit though it will be a longer wait if you need a paper check.

1200 in April 2020. Securely access your individual IRS account online to view the total of your first second and third Economic Impact Payment amounts under the Economic Impact Payment Information section on the Tax Records page. If you need help finding the amounts you received there are a couple of options.

To enter or review your Recovery Rebate aka stimulus payment information in TaxAct follow these steps. Resident alien in 2020 are not a dependent of another taxpayer for tax year 2020 and have a social security number valid for employment that is issued before the. An Economic Impact Payment or EIP is a stimulus payment provided to taxpayers most recently for COVID-19 relief.

The eligibility requirements for the second stimulus payment are the same as the first round of payments issued earlier in 2020. First check if you received and saved Notice 1444 from the IRS. COVID-19 Stimulus Checks for Individuals.

1 online tax filing solution for self-employed. Online competitor data is extrapolated from press releases and SEC filings. Posted by 1 year ago.

When filing with TaxAct you will be asked to enter the amount of your stimulus payment. The IRS issued three Economic Impact Payments during the coronavirus pandemic for people who were eligible. 112500 and 136500 for head of household.

These payments were sent by direct deposit to a bank account or by mail as a paper check or a debit card. With the recent passing of the third stimulus payment youll be asked to enter both payments if received. Tax act online stimulus check Tuesday June 14 2022 Edit.

American Rescue Plan What Does It Mean For You And A Third Stimulus Check Turbotax Tax Tips Videos

600 Second Stimulus Check Calculator Forbes Advisor

Stimulus Check Taxes Will Stimulus Payments Impact Your Taxes

Important Updates On The Second Stimulus Checks Taxact Blog

Register For Your Stimulus Payment Free Easy Online Cares Act

How To Get A Stimulus Check If You Don T File Taxes Updated For 2021

Stimulus Registration Economic Impact Payments Taxact

Irs Finally Launches Registration Tool For Stimulus Checks

How To Claim Missing Stimulus Payments On Your 2020 Tax Return

All You Wanted To Know About Those Tax Stimulus Checks But Were Afraid To Ask

Turbotax Irs Launch Online Portal For Stimulus Check Direct Deposit

Stimulus Checks What To Do If You Haven T Gotten Your Payment Cnn Politics

Nonresident Guide To Cares Act Stimulus Checks

Will I Get A Stimulus Check If I Owe Taxes And Other Faqs Bench Accounting

Third Stimulus And Child Tax Credit Irs Needs Your 2020 Return 11alive Com

U S Expats Coronavirus Stimulus Checks Top Faqs H R Block

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Second Stimulus Check When Will I Get A Covid Relief Cash Payment And How